Investment in Ag tech last year was more than the previous two years combined according to a Financial Times article written earlier this year, but the lack of meaningful exits and the lack of impact on the industry should concern all involved. Many new, ag tech companies claim they want to change the industry but have little idea about how it works from the start. Different business models and financial structures would go a long way towards allowing some of these good ideas to make a real impact on the farms, farmers and investors’ wallets.

Last year $700m was spent on investments in ag tech on deals including data aggregation platforms, robots for scouting fields or spraying weeds, seed microbe treatment, and satellite imagery. After the 2013 purchase of Climate Corporation by Monsanto for $1 billion and high farm profitability had farmers looking for new ways to produce more with record commodity prices, new businesses began popping up left and right. The first notable exits from this pile on have occurred in the last year including Granular for $300 million and Blue River Technology for $305 million. Money has also been flooding into ag land and infrastructure investment. Even with only a few successful investments and exits there continues to be a rush to create new businesses in the industry.

Unfortunately, all of this cash flooding the market has made little difference to how row crop farms actually work. There has been little to compare to the effectiveness of the green revolution or even something more modern like GPS guidance on tractors. Ag tech conferences and accelerators openly discuss the problem of market penetration and adoption. There are few sales channels and fewer customers willing to try something new. The low rate of adoption does not make sense given the amount of money being thrown into new ideas. Why?

Problems – Industry

While there are many problems with the companies themselves, it is worth reviewing a few points about the market into which they are selling. As as been mentioned on these pages before, one business cycle a year creates unique challenges in agriculture. There is only one opportunity to convince customers to try a new product. Further, farms only have once a year to implement anything different in an operation – a process, system, new employee training, etc. Therefore, a company must convince a customer that if he wants to do something new this year, their product is the new thing to try. Maybe the customer doesn’t want to try something new because commodity prices are bad and he just wants to stick with what he knows. Maybe he wants to try something different, but it is not the product the company is selling. In this way companies selling to farmers compete not only against competitors in their product category but also against any company trying to get farms to try something new. Also, with one sales cycle a year, incumbents remain well entrenched. Farms, often rightly, think, “why change something that works?”

Another issue inherent to the agriculture industry is the slow feedback loop. This is a problem both for farmers using the products and for ag tech companies. How is a tech company supposed to improve when it can only get feedback on any process or product it develops once a year? This slows product development and the adaptability of business models as well. One can only learn so much from one’s customers when a product is not used repeatedly. Finally, most customers have limited time to learn about a product or even a category of products because they are stretched thin trying to succeed at the things they only have one chance a year to do well. This slows product feedback and development further, since they have no context for how a product might improve.

The slowed timeline for sales and learning does not usually come with a slowed runway from investors. This is one of the fundamental problems with technology companies in agriculture. To meet investor expectations of growth companies are forced to aggregate users before they have a defined value proposition. The result is pretty user interfaces, and selling a story often with promises of “bringing back profitability to the farmer.” If the story gains traction then maybe the company will be purchased by one of the big ag companies and the story will end well for early investors. This cannot be the only way, though.

Problems – New Companies

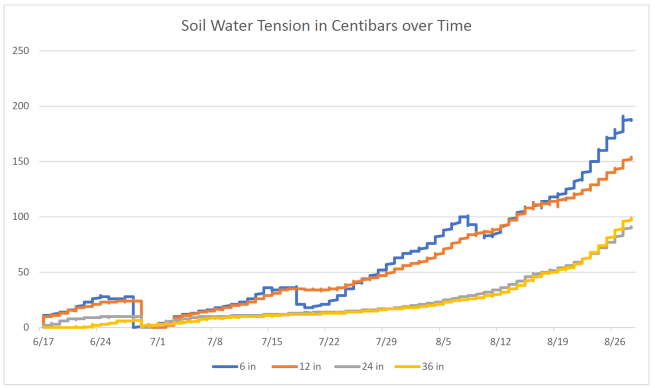

The lack of depth of industry knowledge stops many companies before they even get started. This is easiest to see where companies bring solutions in search of a problems. Soil moisture sensors are a clear example of this. These sensors, in theory, allow a farm to use less water by only irrigating when needed. They are incredibly sensitive to readings they take, and they provide insight into how much water is available for the nearby plants to use at any given time. Unfortunately, the readings they provide are not representative of a decision making unit. Only one sensor provides data on a small location in a very large field often representing an entire collection of fields which comprise a decision making unit. In other words, one must decide to irrigate several hundred acres based on the data from a couple square feet. Obviously, this does not create a statistically relevant data. To put out many sensors is both time and capital intensive. If those problems were overcome, there is another the issue with output from the products available. The customer receives a series of line graphs representing moisture in a specialized unit (how much tension is in the soil or how much electric conductivity) on the y-axis and time on the x-axis with various depths represented by different colored lines. To review several of these graphs several times a week and decide when is the right time to water is no small task. Additionally, the company is asking a farmer to acquire new knowledge in data interpretation in order to be able to make the decision. A better product should give the customer two things.

- A date when irrigation should start (within 3 days)

- An alert if the available water decreases faster than projected.

This is one example of many where companies fail to understand how their product works for the customer. Understanding what really happens on a row crop farm would go a long way toward creating more revolutionary companies.

New ag-tech companies are asking too much of their customers. In a world where farmers are stretched thin new technologies often ask a farmer to do more work. Work ordering systems are a great example. These systems have the potential to be the most significant improvement in the way businesses work in the last 10 years. They allow the collection of data that has allowed other industries to become far more productive but remained unavailable to farmers. This operational data collection will allow a farm to be managed on benchmarks and metrics on a daily basis. For the first time farms have the ability to understand how well the daily work is executed. These systems are the first step in greater understanding of the business of a farm. Also, they help create a better means of communication and verification across an operation. However, the extra work required to get everything right in such a system is at least an extra 10-15 hours of work on a 5000 acre operation per week. A farmer must not only do this work but understand how the tool will fit into his organization as a whole, use it effectively, and be able to make decisions from it when necessary. That said if he can do this work he will have a greater understanding than 99% of his competitors of when and why his business is or is not successful. Unfortunately, most work ordering systems are incredibly complicated, poorly explained and difficult to maintain. These products need to be easier to use and to understand how they fit into a well functioning business. Great products need to fit the market by reducing the amount complexity in a business. They do this by reducing the actions required to complete a process or by simplifying decision making. A new seed treatment, chemical or spray nozzle has a better opportunity of finding traction than a work order management app because the value proposition is much easier to understand. The more simple the user experience and output the greater the attractiveness to busy people being asked to complete an additional task.

Companies are further impeded from progress by the incentive structure of their capital. Even if a tool had the perfect product-market fit, it would take years for it to achieve even 40% market penetration. Having one sales cycle a year keeps growth at a snail’s pace. On the other hand, the money being raised for these companies is used to holding periods of 5 years or less in a company. It is extremely difficult for a company in agriculture to make significant progress in a 3-5 year time frame. The need to create returns for investors keeps companies from building a product that changes how farming works and focuses them on gaining market share with sales tactics more than creating real value.

Solutions

There are a few solutions which will go a long way to improving some of these issues. Most of them involve aligning incentives with the farmer or business owner.

The fastest way to speed the learning process is to find someone who understands the industry and its problems. While it may seem that would be easy, finding a guide who can see the forest despite the trees is anything but. This person should have the following qualities.

- He should have worked for a farm, crop scout or input vendor for 3 years recently and have performed farm labor for at least 5 years at some point in his life.

- He should have a basic understanding of the cash flows of a farming business.

- He should have a basic understanding of a typical crop production plan for the prominent crops in a region.

- He should have a working knowledge of what a farmer and farm hand does every day of each part of a growing season as well as the typical obstacles each is likely to encounter.

From a customer’s and investor’s perspective, making sure a company has this person is a very clear signal that they have a better than average understanding of the problems of their customer. It shows an understanding of the market when the person related to the industry in the company has real, deep knowledge. Also, it shows a founder from outside the industry has enough humility to realize he does not know it all. All too often people receive funding because they have done something impressive in the past that is unrelated to the industry they are trying to enter. An insider at the top of the organization mitigates execution risk.

Making a business model simple will enable a company to more easily demonstrate the value of a product. Too many transactions in farming are complicated. For instance, chemical prices are never clear. Vendors quote prices in different units and vastly different price point. Even when one receives a price, it may have a rebate that is paid to the farmer after the season. It is no wonder that people enjoy driving and working on machinery. There is clear, demonstrable progress. The best business models in farming are like this. There is a clear cost and demonstrable value proposition. If company sells widgets, it should not provide that widget to the market in the form of a service and charge a monthly subscription or per acre fee. The best businesses in the farming industry sell a product for a very clear price, demonstrate value, grow the business, then find another related problem to solve.

Properly arranging a testing phase produces the best results for the development of the product. This will also create customers who will market for you. The best test phase mitigates the risk of time investment in the first year of trials. A farmer buys a new product because he believes it will make his life easier or his business more profitable. He does not buy a product because he needs more to do. If a company sells a product which goes in a field or on a crop, it should do the first year’s trial and monitor the results on the farm. That way a farmer does not have to think about keeping track of the test himself and the company guarantees it gets back good data. Then, the results from the test should prove themselves and make a sale the next year. If one sells a service or a tool, then one should ensure the proper setup and ongoing management and success of the tool on a weekly basis. Replacing any old system is difficult. Implementing a totally new system where there has been none before is nearly impossible. That does not mean that it is not worthwhile. Ensuring product success is vital for any tool. By making it easy for farms to point to the success of a product after the season a company ensures higher customer retention and proves out the company’s progress.

Since no one can have all the knowledge to run the increasingly complex modern farm, more pure service companies performing basic tasks are needed to help farmers get it all done. Farmers need help performing specialized tasks related to their business and should be able to hire services to supplement their own knowledge and workforce. For instance, in the finance industry one can hire various companies to do many back office tasks. Why can’t farmers do the same for basic accounting and regulatory tasks? There are companies which help implement and use tools like Salesforce. Why aren’t there companies that help farmers implement and monitor work order management systems? There are unlimited services like this that a farm could use to improve its operations. There are even tasks that a farmer cannot or does not want to do which service companies should do. Businesses selling to farmers could use other services to monitor the effectiveness of their products or the effectiveness of those to whom they lend money. Create businesses that do work others find boring or tedious.

The funding model for new agriculture companies needs to change if the companies want to impact the industry. Investors’ timelines should match the slow cycle within which agriculture exists. For now companies are raising money, building a brand, selling promises to investors, and passing on companies with customers eagerly awaiting solutions to large incumbents. The businesses that will make it in the long term are those which provide real value to their customers in the first year and expand steadily while providing new and better services. Say what you may about the industry leaders of today, but they have done exactly this and have been enormously successful. Funding for the successful company should be internal and generated from current cash flows or its investors should have an appropriate timeline of 10 years or more. Ag only funds could provide the right kind of infrastructure, investment expectations and timeline for companies wanting to grow in the industry. They will understand appropriate growth rates, timelines and industry quirks. For now, those on a mission to grow and quickly exit will absolutely make money. They may even make changes in the short term. However, few will last to make significant impact unless they are focused on the long term – tens of years not tens of months.

Final Thoughts

So given all of this, how should a business ideally build a business model and pitch a product to a farm or ag business?

Assuming your idea and product already exists and that it solves a real problem:

- Show with pictures and graphs multiple examples of a product working

- Make clear what the price is, how much and if it will change, and what is the anticipated ROI from the product

- Provide clear expectations of what the product will deliver

- Provide a trial at a reduced cost or with a money-back guarantee if expectations are not met

- Monitor the progress and outcomes for that trial

- Collect simple, clear data to show success

- Repeat

There are many, many opportunities to improve the industry and create value for farmers, landowners and other companies in agriculture. Fully understanding the problem to be solved and how it fits into the bigger picture before going to market is critical to success.